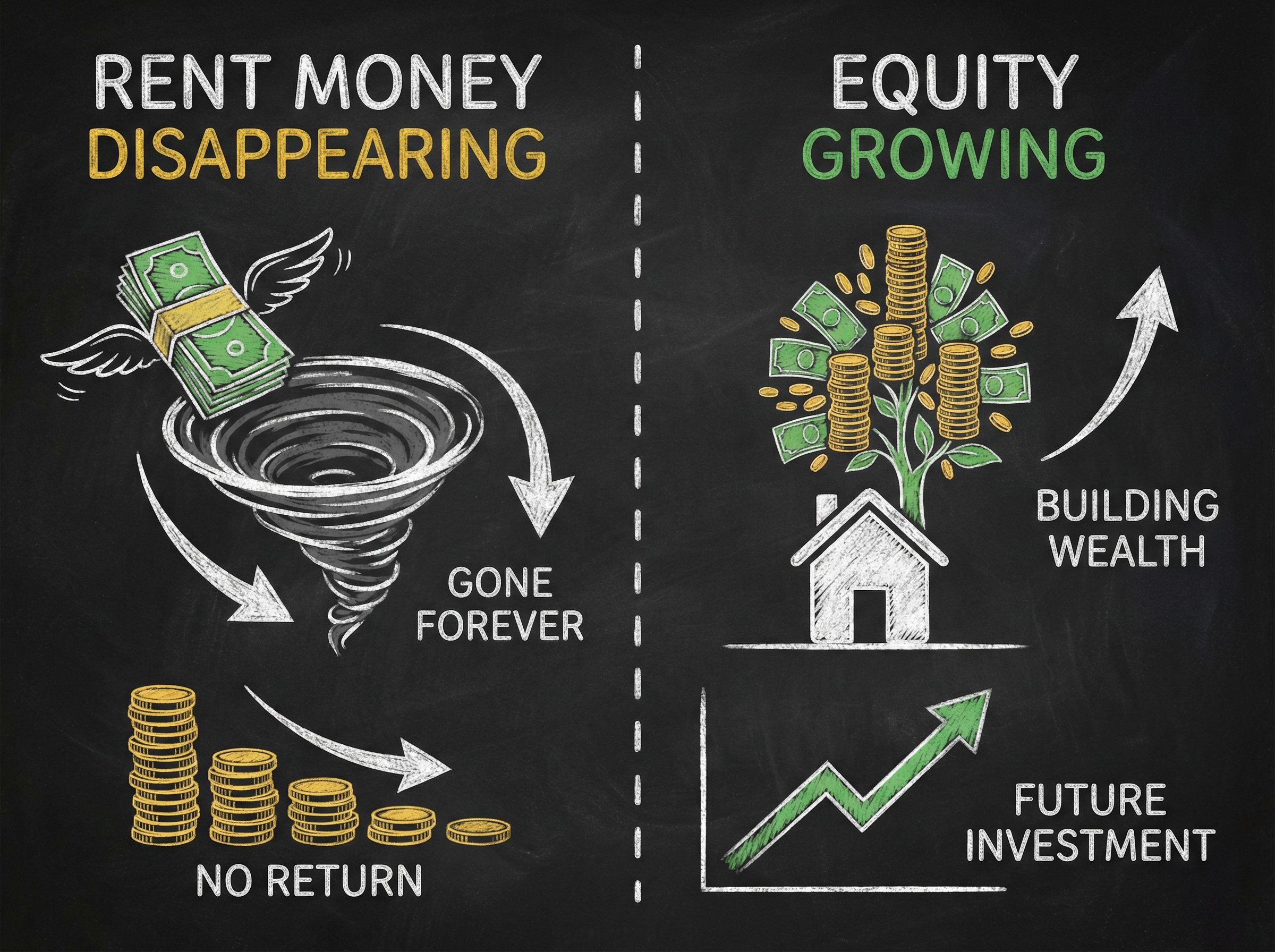

Chart showing “Rent Money Disappearing” vs. “Equity Growing”

Deciding whether to buy a home or rent can feel confusing at first. After all, this is one of the biggest financial decisions you will make. However, when you break it down step by step, the decision becomes much easier.

In today’s Florida housing market, both renting and buying have advantages. On one hand, renting gives you flexibility. On the other hand, buying helps you build long-term wealth and stability.

Therefore, understanding the pros and cons of buying vs renting is the first step toward making the best decision for your future.

Understanding the Difference Between Buying and Renting

Before comparing, let’s look at what each option means.

Renting

When you rent, you pay a monthly amount to live in someone else’s property. You get flexibility, but you do not build ownership.

Buying

When you buy a home, your monthly mortgage payment helps you own more of your home over time. This is called equity.

In other words:

- Renting builds your landlord’s wealth

- Buying builds your wealth

Because of this, many people choose to buy when they are financially ready.

Benefits of Renting

Renting is often easier in the short term. For example, you don’t need a large down payment, and your landlord usually handles repairs.

Benefits of Renting

- Lower upfront costs

- Easier to move

- No repair expenses

- Good for short-term living

- Flexible for job changes

However, renting has one major downside: you do not build ownership. Additionally, rent can rise every year.

Benefits of Buying a Home

Buying a home has many long‑term advantages. Most importantly, it helps you build equity, which is the amount of the home you truly own.

As a result, buying a home can help you grow wealth over time.

Benefits of Buying

- Build equity

- More stable monthly payments

- Home value can increase

- Possible tax benefits

- More control and freedom

Furthermore, homeowners don’t have to worry about surprise rent increases.

Cost Comparison: Buying vs. Renting

At first, renting may look cheaper. However, over several years, buying is often the better financial decision.

Example:

Renting:

$2,500/month × 5 years = $150,000

➡️ You own nothing.

Buying:

$2,500/month for 5 years

➡️ You build equity and own an asset.

Therefore, buying helps your money work for you instead of disappearing.

When Renting Makes More Sense

Renting might be better if:

- You plan to move soon

- Your income is unstable

- You don’t have savings yet

- You’re not ready for responsibility

- You want flexibility for work or travel

For example, if you expect to move within 1–2 years, renting may be the safer choice.

When Buying Makes More Sense

Buying may be better if:

- You plan to stay at least 3 years

- You have a stable income

- You want to build wealth

- You want more stability

- You’re tired of rent increases

In fact, many homeowners say they wish they had bought sooner.

Florida Market Insight for 2026

In 2026, the Florida housing market is becoming more balanced, meaning buyers have more choices and less competition than in prior years. Because of this, it is becoming easier to buy.

Additionally, rent prices across Florida remain consistently high, especially in coastal cities. Therefore, buying can often be the smarter long-term decision for many families.

Questions to Ask Yourself Before Deciding

Ask yourself:

- Will I stay here at least 3 years?

- Do I have stable income?

- Do I want to build wealth?

- Am I tired of rent increases?

- Do I want stability or flexibility?

If you answered “yes” to most of these, buying may be the better option. However, if you value freedom and low responsibility, renting might fit your lifestyle better.

Is It Better to Buy or Rent in 2026?

Ultimately, the decision to buy or rent depends on your goals, finances, and lifestyle.

Renting is better for flexibility and short-term living.

However, buying is better for stability, equity, and long-term wealth.

In today’s Florida housing market, many renters are discovering that buying is more achievable than they thought.

Therefore, if you plan to stay in one place and want to build wealth, buying may be the smarter choice.

The most important step is understanding your options and creating a plan that fits your future.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link