A beautiful South Florida Home

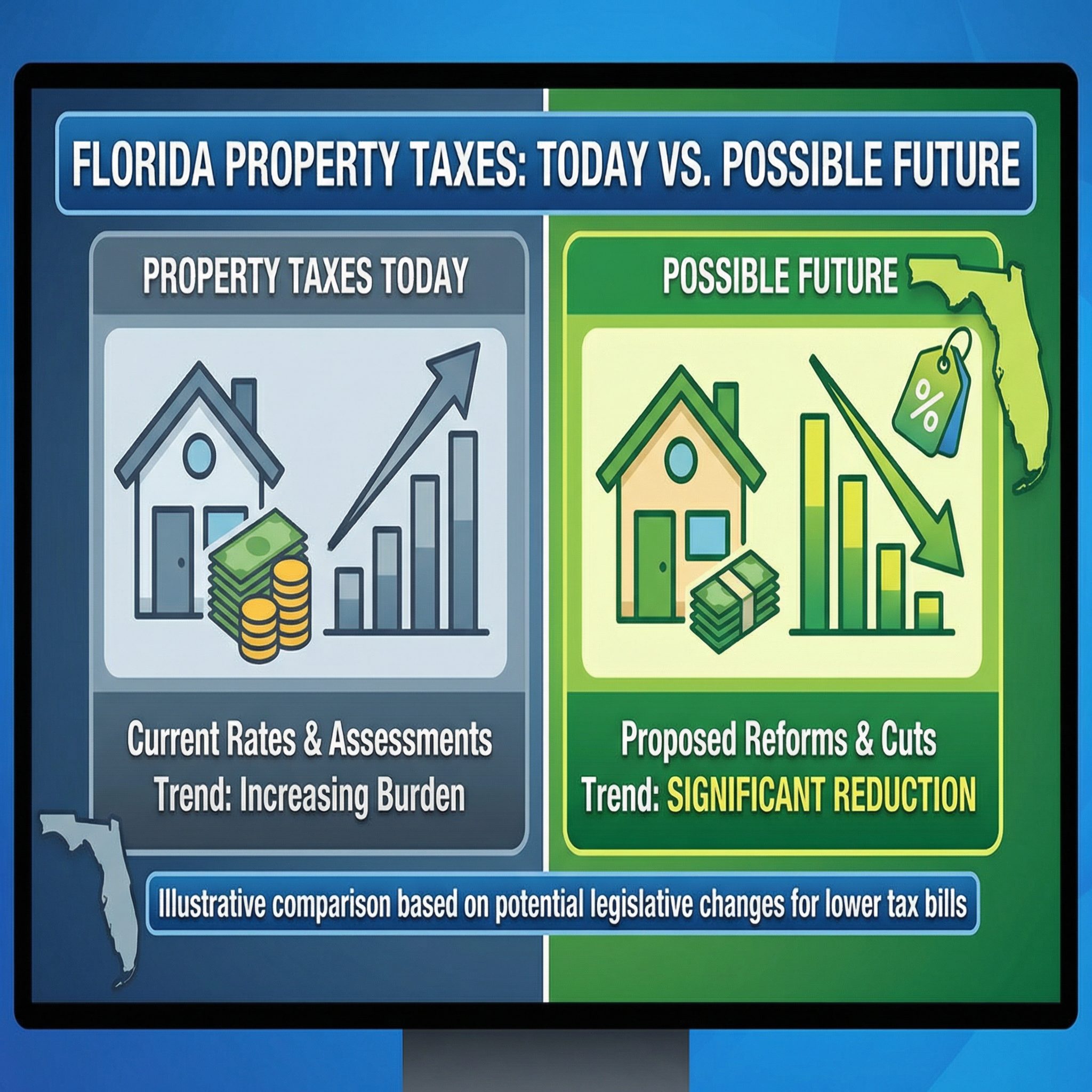

Florida may be heading toward one of the biggest tax changes in its history. Recently, state leaders introduced plans that could greatly reduce or even eliminate property taxes for homeowners. Because property taxes affect nearly everyone who owns a home, this proposal has sparked strong opinions across the state.

On one hand, many Floridians welcome the idea of lower taxes. On the other hand, many experts worry about how cities and counties would pay for important services without that money.

So, what exactly is Florida planning? And more importantly, what does this mean for current residents and out-of-state buyers? Let’s break it down in a simple way.

What Is Florida Proposing?

Right now, Florida lawmakers are discussing several proposals that would slowly phase out property taxes, especially on primary homes that qualify for the homestead exemption.

Instead of removing property taxes all at once, the plan would reduce them little by little over many years. Eventually, homeowners could pay very little or no property tax on their main residence.

However, it is important to understand that nothing has been approved yet. Before any major change happens, voters would need to approve a constitutional amendment during a future election.

Why Is Florida Considering This Change?

First of all, property taxes have increased sharply in many parts of Florida. As home values rise, tax bills rise too. Because of this, many homeowners especially seniors and families on fixed incomes are struggling to keep up.

At the same time, Florida does not have a state income tax. Because of that, some lawmakers believe property taxes are an unfair burden and want to shift the tax system to something else, like sales taxes or service fees.

In addition, Florida continues to attract new residents from high-tax states. As a result, leaders see tax reform as a way to keep Florida affordable and competitive.

How Would This Help Florida Homeowners?

If property taxes are reduced or removed, homeowners could see several benefits.

First, monthly housing costs would go down, especially for people who own their homes outright. That could make it easier for seniors to stay in their homes longer.

Next, homeowners would have more predictable expenses. Instead of worrying about rising tax bills every year, families could better plan their budgets.

Finally, lower taxes could make owning a home in Florida even more appealing, which may increase long-term stability for many neighborhoods.

What Are the Concerns?

Even though lower taxes sound great, there are serious concerns.

Property taxes help pay for local services, including:

-

Public schools

-

Police and fire departments

-

Road repairs

-

Parks and libraries

If property taxes disappear, that money has to come from somewhere else. Otherwise, local governments could be forced to cut services or raise other taxes.

Because of this, many experts worry that Florida could end up with:

-

Higher sales taxes

-

New fees on services

-

Increased costs in other areas

In other words, homeowners might save on property taxes but pay more in different ways.

How Could This Affect Home Prices?

Lower property taxes often make homes more attractive to buyers. As a result, demand could increase.

When demand goes up, home prices often rise. So, while homeowners might save on taxes, future buyers could face higher purchase prices.

Therefore, it’s possible that property tax savings could be partially offset by higher home values, especially in popular areas like South Florida.

What Does This Mean for Out-of-State Buyers?

For buyers moving to Florida from other states, this proposal could be very appealing.

First, Florida already offers no state income tax. If property taxes are also reduced, Florida could become one of the most tax-friendly states in the country.

As a result, out-of-state buyers may:

-

Rush to buy before prices rise

-

See Florida as a long-term tax savings opportunity

-

Increase competition in already hot markets

However, buyers should also be aware that if property taxes are removed, other taxes may increase. That could affect overall affordability over time.

What Should Buyers and Homeowners Do Now?

At this point, the best step is to stay informed. These proposals are still being debated, and many details could change.

Homeowners should:

-

Watch for updates on ballot measures

-

Understand how their local services are funded

-

Plan for both short-term savings and long-term changes

Buyers, especially those from out of state, should:

-

Work with a knowledgeable local real estate professional

-

Understand total ownership costs, not just taxes

-

Move strategically, not emotionally

To Bring This to an End

Florida’s plan to abolish property taxes could reshape the housing market for years to come. While the idea offers clear benefits, it also brings serious questions about funding, affordability, and long-term impact.

For both Floridians and out-of-state buyers, the key is balance. Lower taxes can be exciting, but smart planning and good information matter even more.

If you’re considering a move to Florida or want to understand how this affects your property, we’re here to help!

Remember: Knowledge is power in real estate. By staying informed in 2026, you’ll make the best decisions for your future.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link