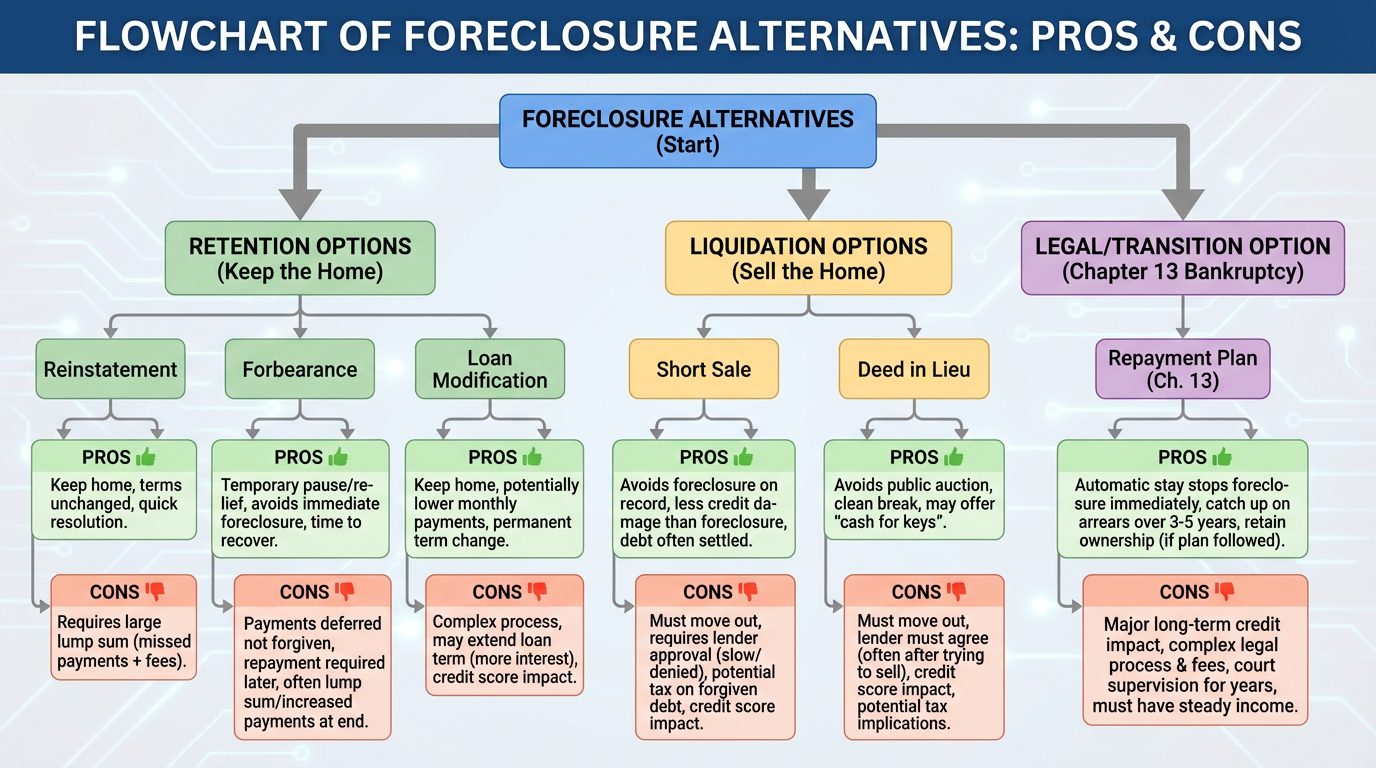

Flowchart of foreclosure alternatives with pros and cons

Falling behind on your mortgage can feel scary. However, you are not alone. In fact, thousands of Florida homeowners face financial hardship each year due to job loss, medical bills, divorce, or rising expenses.

But here’s the good news: foreclosure is not your only option.

There are several foreclosure alternatives in Florida. Each option has benefits and risks. Therefore, it is important to understand them before making a decision.

Let’s break them down clearly and simply.

Why Avoid Foreclosure?

First, let’s talk about why foreclosure can hurt.

Foreclosure can:

-

Lower your credit score by 100–160 points

-

Stay on your credit report for up to 7 years

-

Make it harder to buy another home

-

Add stress and legal costs

Because of this, many homeowners look for better solutions.

1. Loan Modification

A loan modification changes the terms of your current mortgage. For example, the lender may lower your interest rate, extend the loan term, or add missed payments to the end of the loan.

✅ Pros:

-

You keep your home

-

Lower monthly payments

-

Avoid foreclosure on your record

❌ Cons:

-

Approval is not guaranteed

-

Paperwork can be long and stressful

-

Trial period payments may be required

2. Repayment Plan

With a repayment plan, the lender allows you to catch up on missed payments over time while continuing regular payments.

✅ Pros:

-

Simple solution

-

Keeps foreclosure off your record

-

Good for short-term hardship

❌ Cons:

-

Monthly payments may increase temporarily

-

Not ideal for long-term financial problems

3. Forbearance

Forbearance allows you to pause or reduce payments for a short time.

✅ Pros:

-

Immediate relief

-

Helpful during job loss or medical emergency

❌ Cons:

-

Payments are not forgiven

-

Lump sum may be due later

-

Temporary solution only

4. Short Sale

In a short sale, you sell your home for less than what you owe. The lender agrees to accept the lower amount.

✅ Pros:

-

Less damage to credit than foreclosure

-

Avoids public foreclosure process

-

Possible relocation assistance

❌ Cons:

-

Lender approval required

-

Can take several months

-

You must prove hardship

5. Deed in Lieu of Foreclosure

This means you voluntarily transfer ownership of your home to the lender instead of going through foreclosure.

✅ Pros:

-

Faster than foreclosure

-

Less public

-

May reduce legal costs

❌ Cons:

-

You lose the home

-

Credit still affected

-

Not all lenders accept it

6. Selling Before Foreclosure

If you still have equity, selling your home may be the best option.

In fact, in many parts of South Florida, home values have increased over the past several years. Therefore, some homeowners can sell, pay off the mortgage, and walk away with money.

✅ Pros:

-

Protects your credit

-

You may walk away with cash

-

Full control of the sale

❌ Cons:

-

Must act quickly

-

Market conditions matter

Which Foreclosure Alternative Is Best?

The right choice depends on:

-

Your income

-

Your hardship situation

-

Your home equity

-

Your long-term goals

Because every case is different, it is important to speak with a knowledgeable real estate professional and possibly a housing counselor.

The sooner you act, the more options you have.

Foreclosure alternatives in Florida can help you protect your credit, reduce stress, and regain control. However, waiting too long can limit your choices.

If you are behind on payments, take action now. There are solutions available.

You deserve clear information and real options.

To help homeowners make informed decisions, we are hosting a Foreclosure Educational Workshop on February 19th at 6:00 PM.This workshop is designed to provide clear, educational information so you can understand your options and make the best decision for your situation.

If you or someone you know is facing foreclosure, sign up for the workshop using the link below.

click here to reserve your spot.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link